By ABUBAKAR YUSUF

The Registrar General, Corporate Affairs Commission CAC, Alhaji Garba Abubakar said Nigeria cannot afford to play down on its efforts to ensure ease of doing business in the country.

According to the Registrar General Person with Significant Control Register also known as Beneficiary Ownership Register (BOR) wlll address the illicit financial flows within and outside Nigeria and also create enabling environment for investors and business owners.

Garba Abubakar made this assertion in his remarks at the launch of the Nigeria’s Public Central Register of Company Beneficial Ownership Information

on Thursday, in Abuja.

The Registrar recalled that at the landmark Anti-Corruption Summit held in London on 12th May 2016, President Muhammadu Buhari made a commitment on Beneficial Ownership Transparency when he stated that Nigeria was committed to establishment of a public central register of company beneficial ownership information, implementation of bilateral arrangements that will ensure law enforcement in one partner country has full and effective access to the beneficial ownership information of companies incorporated in the other partner country, and joining the pilot initiative for automatic exchange of beneficial ownership information.

“President Buhari had assured the global community that Nigeria is committed to signing the Open Government Partnership initiatives.” Abubakar stated.

Alhaji Garba Abubakar accordingly explained” What we are witnessing today is the demonstration of these commitments by Mr. President.

It is very instructive to note that out of the 43 countries that attended the Summit, Nigeria was one of the only six countries that promised to establish public central registers of true company ownership amidst global concerns on the misuse of companies and other corporate arrangements to hide the proceeds of corruption and evade tax.

Other five countries were Afghanistan, France, Kenya, the Netherlands and United Kingdom) .

“The imperatives of transparency in beneficial ownership was further underscored by the Vice President, Professor ‘Yemi Osinbajo, GCON on 14th July 2020 at the Africa Regional Webinar on Combating Corruption and Illicit Financial Flows held to commemorate the 20th Anniversary of the Independent Corrupt Practices and Other Related Offences Commission (ICPC).

On that occasion, the Vice President had stated as follows –

“For us in the developing world and especially in Africa, breaking the wall of secret corporate ownership is crucial because secrecy around corporate ownership is implicated in our underdevelopment.

Although anonymous companies are not always illegal, nevertheless secrecy provides a convenient cover for criminality and corruption”.

On why the Commission embarked on the initiative,Abubakar said Immediately after the London Summit, Nigeria progressed its commitment to the principles of Open Government Partnership (OGP) by a formal expression of intent to join the OGP.

He added that Nigeria was confirmed as a participating country by the OGP Secretariat on 27th July 2016.

“Prior to this, the Inter-Governmental Action Group against Money Laundering in West Africa (GIABA) had, in 2014, recommended Nigeria for membership of the Financial Action Task Force (FATF).

“The bases for the recommendation were stated to include the extent of Nigeria’s implementation of Anti-Money Laundering and Counter Financing of Terrorism (AML/CFT) measures, involvement in GIABA work and high political commitment to advancing the implementation of AML/CFT regime of acceptable international standard.

Implementing the various commitments to transparency in both public and private sector governance required reforms to both the legislative and enforcement frameworks.

Thus by 2018, the Commission was already partnering with Open Ownership (OO) , OGP and the World Bank to achieve the necessary reforms. In August 2020, the most significant hurdle was crossed. The Companies and Allied Matters Act 1990 was repealed after three decades and a new Companies and Allied Matters Act (CAMA 2020) was signed into law by Mr. President.

The new Act contained the required statutory framework for Beneficial Ownership (Persons with Significant Control (PSC)) Transparency.

“The next stage in implementation of the commitments was to develop the necessary technological solution and enforcement framework. Still working with OO, OGP and World Bank, the Commission was able to put together the Persons with Significant Control Regulations (PSCR).

“The PSCR detailed the reporting obligations for reporting entities; the information to be reported; the timelines for reporting; the application of the Regulations to State Owned Enterprises (SOEs), Politically Exposed Persons (PEPs), Foreign Companies exempted from registration; and the sanctions (administrative and criminal) for infractions.

The PSCR was approved by the Honourable Minister of Industry, Trade and Investment, His Excellency Otunba Richard Adeniyi Adebayo (CON) on 23rd November, 2022. The implementation had since commenced”Abubakar maintained.

Alhaji Abubakar restated that the launch of the Person with Significant Control Register marked the final step in the implementation of the country’s commitment seven years ago to establish a public central register of company beneficial ownership information.

“I wish to, at this point, acknowledge and appreciate the roles of the World Bank and our own Federal Ministry of Finance. They assisted with funding for the development of the Register.

In the same vein, our gratitude goes to the Open Ownership for the technical support provided at no cost to us. To you all, we say a big “Thank You”.

THE PERSON WITH SIGNIFICANT CONTROL REGISTER (PSC REGISTER)” He explained.

Alhaji Garba Abubakar further stated that the PSC Register was developed and implemented by the CAC, utilizing cutting-edge technological solutions that support end-to-end electronic disclosure of PSC information by reporting entities to the Commission and publication of the information to the general public in the form of a web-search or specialized formats (e.g. JavaScript Object Notation (JSON) and Comma Separated Values (CSV)).

The solution featured a public facing search portal (htttps://bor.cac.gov.ng) that enables the general public access to beneficial ownership information on relevant incorporated entities in Nigeria.

Any of several search parameters may be used on the search portal. The parameters include:

• Entity name

• Entity registration number

• Name of the PSC (first name, surname or full name)

He however, maintained that the information provided to the general public does not include Personally Identifiable Information (PII) like National Identification Number (NIN), complete date of birth, residential address, phone number, etc.

“This is in compliance with the National Data Protection Regulation (NDPR) issued by the National Information Technology Development Agency (NITDA).

“The solution also features an enterprise service bus for data exchange via the Application Programming Interface (API), which enables data sharing with competent authorities, security agencies and authorized organizations (local or international).

“The information in the PSC Register is available and accessible at no cost to the general public. With the introduction of the Register, any person can easily ascertain who owns what in Nigerian companies and limited liability partnerships.

The expectation is that the Register would greatly enhance the fight against corruption and criminality by facilitating investigations by law enforcement agencies into the true ownership and control of companies and limited liability partnerships; supporting Civil Society Organisations (CSOs) in promoting citizens’ participation in public accountability and governance, as well as strengthening the capacity of the media to perform their traditional roles as watchdogs of the society.

Users of the Register are encouraged to report any incorrect information observed in the Register to the Commission using the report interface on the Register” RG stated.

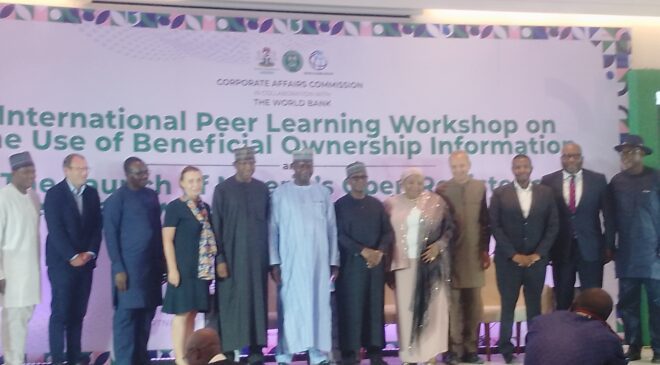

The unveiling of the initiative was witnessed by;Reprentatives of Ministers of Trade and Investment, Budget and National Planning,Country Director,World Bank, Shubham Claudhuri, Sanjay Pradhan, CEO,IGP Support Unit,Tom Townsend,CEO,Open Ownership, Wilson Banda, Registrar and CEO, Zambia Patents and Companies Registration Agency, Government Officials, among other stakeholders.

Goodwill messages from all stakeholders present.