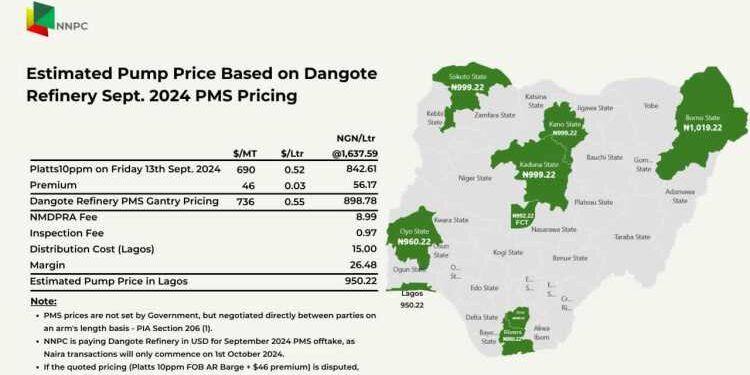

According to NNPC Ltd., the prices are based on Sept. 2024 pricing.

The NNPC Ltd. said it bought fuel from the Dangote Refinery at N898 per litre for PMS offtake.

Mr Olufemi Soneye, the Chief Corporate Communications Officer, NNPC Ltd. made this known on Monday.

This followed a denial by Dangote Refinery on Sunday after the NNPC Ltd.’s initial disclosure of N898 pump price obtained from the refinery.

The News Agency of Nigeria (NAN) reports that the Dangote Refinery commenced the first loading of PMS at its facility in the Ibeju-Lekki area of Lagos State on Sunday.

The Refinery had on Sunday described the disclosure made by the NNPC Ltd. as ‘misleading and mischievous’ aimed at undermining the milestone achievement recorded by the refinery in addressing Nigeria’s energy insufficiency.

Dangote Refinery’s Group Chief Branding and Communications Officer, Anthony Chiejina had in a statement urged Nigerians to disregard NNPC Ltd.’s statement and await a formal announcement on the pricing by the Technical Sub-committee on Naira-based crude sales to local refineries on Oct. 1.

Chiejina, while failing to tell Nigerians the price at which the refinery sold its fuel to the NNPC Ltd., said its current stock of crude was procured in dollars and sold to the NNPC Ltd. in dollars with a lot of savings against current imports.

Reacting to this, the NNPC Ltd.’s Spokesperson said in line with the provisions of the Petroleum Industry Act (PIA), PMS prices were not set by Government, but negotiated directly between parties on an arms length.

“The NNPC Ltd. can confirm that it is paying Dangote Refinery in United States Dollars (USD) for September 2024 PMS offtake, as Naira transactions will only commence on Oct. 1, 2024.

“The NNPC Ltd. assures that if the quoted pricing is disputed, it will be grateful for any discount from the Dangote Refinery, which will be passed on 100 per cent to the general public.

“Attached to this statement are the estimated pump prices of PMS obtained from the Dangote Refinery across NNPC Retail Stations in the country, based on Sept. 2024 pricing,” the spokesperson said.

Based on the estimated PMS pump prices document, N950.22 is showed as the estimated pump price in Lagos of fuel sources from the Dangote Refinery, indicating selling price at NNPC’s retail stations in other states to be higher as transport costs will be factored in.

The estimated price document also revealed that the NNPC Ltd. paid the refinery N898.78 per litre for PMS, while the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) fee is N8.99 and inspection fee is N0.97.

It also showed that Distribution cost (Lagos) is N15, while ‘Margin’ is N26.48. (NAN)