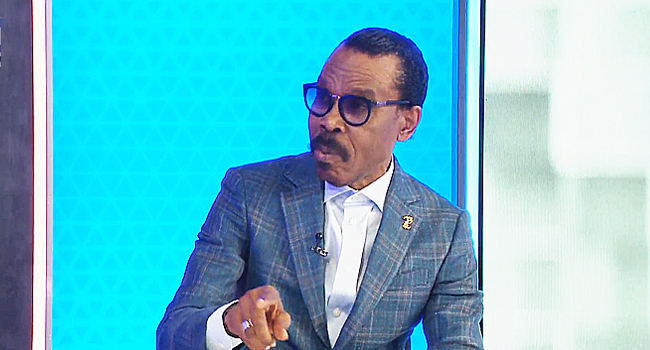

The Chief Executive Officer of the Financial Derivatives Company, Bismarck Rewane, has emphasised the need for Nigeria to adopt a pragmatic and balanced approach to managing its fragile economy.

Speaking on Channels Television’s Business Morning, the financial expert cautioned against drastic expenditure cuts, highlighting the importance of security, investment, and inflation control.

His remarks follow a report by the International Monetary Fund (IMF), which suggests Nigeria’s economic outlook is marked by significant uncertainty.

When asked about cutting government spending, Rewane drew a vivid analogy, stating that cutting expenditure is not the same as optimising it.

“The IMF is advising that we optimise expenditure, as there are numerous leakages at both state and federal levels, which act as a negative investment multiplier,” he explained. “But to ask us to cut our expenditure at a time when we need to invest more is like asking a man with an ulcer to go on a fasting mission.”

However, he warned that exemption from spending cuts does not mean free spending for the government at both state and federal levels. “We must optimise expenditure, not spend like drunken sailors,” he said.

Rewane acknowledged the necessity of President Bola Tinubu’s reforms, such as the removal of fuel subsidies and currency realignment, but stressed that these measures alone are inadequate for achieving economic stability.

“We must stop looking backwards,” he said. “What was appropriate in 2023 may not suffice for 2025.”

He also highlighted the challenges posed by insecurity in oil-producing regions, which continue to hinder Nigeria’s economic recovery. Without resolving these issues, oil production—a key revenue source—will remain underwhelming.

Inflation and Fiscal Challenges

Commenting on inflation, Rewane expressed cautious optimism, predicting a modest rise to 25–27%, contrary to the IMF’s projection of 30% in 2025 and 37% in 2026.

He pointed out that continued liquidity in the system may force the Central Bank of Nigeria to maintain or increase interest rates to manage inflation expectations.

Rewane criticised the Debt Management Office (DMO) for reducing bond issuance from ₦1.8 trillion in the first quarter of the year to ₦1.2 trillion in the second quarter, calling it a step in the wrong direction.

“Increased bond issuance is key to mopping up liquidity and controlling inflation. This is one of the painful choices we make to control inflation,” he noted.

He also raised concerns about Nigeria’s undervalued crude oil exports, stating, “We sell for 70 cents, while our neighbours get $1.20. How long can this go on?”

While praising the Dangote Refinery for reducing local fuel prices, he warned that plans by the Organisation of Petroleum Exporting Countries (OPEC) to increase output could further depress oil prices.

On the global front, Rewane addressed US President Trump’s signal to reduce tariffs on China, noting that while it could ease pressure, uncertainty would persist.

He predicted greater stability between May and June, adding that any recession as projected by the IMF would likely be mild and not deep.

“I don’t believe the world can live with unexpected gyrations. Yes, a recession may come, but it will be mild, not deep,” he said.

Rewane concluded by stressing the need to fill Nigeria’s fiscal gap through borrowing, reducing leakages, and fiscal consolidation.

“These are serious times, and we must respond with serious adjustments,” he said.