The Federal Government of Nigeria has said it is not discussing debt forgiveness with China, noting that Beijing is willing to lend Nigeria more money and invest more in the economy of Nigeria.

The Minister of Foreign Affairs, Yusuf Tuggar, stated this on Channels Television’s Sunday Politics programme.

Nigeria has been making proposals for debt forgiveness at the United Nations General Assembly for some years now but this hasn’t been achieved.

At the recent 79th session of the United Nations General Assembly (UNGA) in New York, President Bola Tinubu, represented by Vice President Kashim Shettima, pushed for reform of the international financial system to include “comprehensive debt relief measures, to enable sustainable financing for development”.

Asked whether any of the multilateral or bilateral loans obtained by Nigeria was cancelled at this year’s UNGA, the foreign minister said, “Under President Obasanjo, we benefited from debt forgiveness. It’s a process; it’s not just an event, it takes time but you have to be there, you have to be present, and then these things happen, they don’t happen overnight.

“The effect that we felt the last time we had debt forgiveness did not just happen with one UNGA.”

According to the Debt Management Office (DMO), Nigeria’s external debt stock as of March 2024 was N56trn ($42bn) while domestic debt stood at N65trn ($46.29).

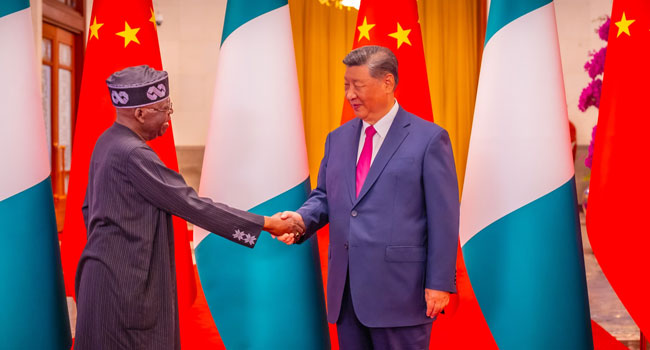

China is one of the lenders of Nigeria. Asked whether Nigeria is in talks with Beijing for debt relief considering that Tinubu met with his Chinese counterpart, Xi Jinping of late, the minister said that was not the case.

Tuggar said, “No, that is not what we are discussing with China. And when it comes to the issue of debt, look at the debt-to-GDP ratio of Nigeria, we are not even among the critically indebted nations.

“When you talk about the debt of a developing country, Nigeria is not in that sort of precarious situation. As a matter of fact, China is prepared to lend more, China is prepared to invest more in Nigeria in terms of infrastructure development and other things.”

The minister also said Nigeria would join BRICS+, a nine-member economic and political force, at the right time.

As of December 2004, Nigeria owed a total of $36bn (which amounted to N4.8trn at the exchange rate of N134/$1). $30.84bn of the country’s external debt at the time was borrowed from the Paris Club, alongside other bilateral and multilateral facilities.

The Paris Club is an official group of money lenders formed in 1956 with headquarters in Paris, France. Nigeria borrowed funds for developmental projects from members of the group such as the UK, US, France, Germany, Japan, Netherlands and eight other countries. Some of the funds borrowed were long before Obasanjo’s administration.

President Olusegun Obasanjo’s debt relief campaign in 2005 saw the Paris Club grant Nigeria a debt relief of $18bn out of the $30.8bn outstanding. As an exit strategy, Nigeria paid Paris Club creditors $12.4bn which represented $6.3bn regularisation of arrears and a balance of $6.1bn.