Bancassurance major growth driver for Cambodian insurance – regulator

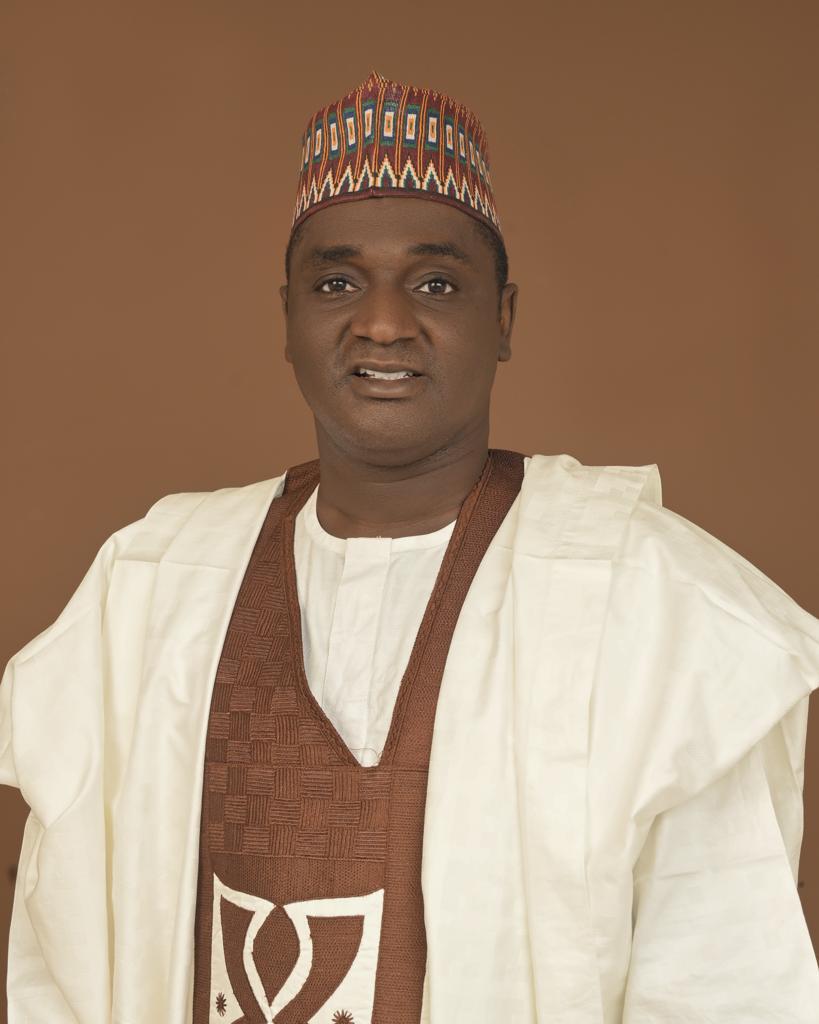

Bancassurance is playing a key role in driving the growth of the Cambodian insurance market as it accounted for 40% of total sales in 2022, according to Insurance Regulation of Cambodia (IRC) director general Bou Chanphirou.

The sector’s gross insurance premium reached more than $330 million in 2022, and Chanphirou said the banking sector was a major driver of this growth. By the end of last year, he said that there are 40 insurers operating in Cambodia with total assets of approximately $1 billion and equity fund of more than $400 million.

The growth in 2022 was a 10.6% rise compared to 2021, which recorded $299.8 million in gross insurance premium. Overall, Chanphirou said that the country’s insurance market has grown at an average annual rate of 25% over the last 10 years.

Bancassurance domination stems from new regulation

In an article from the Khmer Times, Chanphirou said that the domination of bancassurance has resulted from the new regulation of the National Bank of Cambodia (NBC). This allows banks and other financial institutions to apply a direct sale or agent model as opposed to the previous referral model.

“Such a new model of bancassurance can bridge the gap between the two financial worlds by linking banks and financial institutions with insurers to provide consumers access to essential financial protection,” Chanphirou said. “Banks and financial institutions and insurance companies are the two inseparable operators which work together for the development as well as the growth and competitiveness of the financial market.”

The potency of bancassurance can also be attributed to the “Cambodia Strategic Development Plan for Insurance Sector 2021-2030,” a circular that defines the distribution of insurance products in the country. Banks and financial institutions being allowed to distribute insurance products has shown enormous potential.

Chanphirou also said that the IRC is co-developing a code of conduct for insurance agents with various insurance institutions which will be adopted soon.

Despite the strong growth across the sector and the major driving force that is bancassurance, Chanphirou said that the insurance penetration rate in Cambodia is still only 1.17%, with a density of $20.47 per capita. While this is low compared to other countries in the region, he said that it also had an attractive growth potential.

“In 2023 and the coming years, I am confident that more insurance products can be sold via bancassurance which would contribute more to the insurance market which has a huge potential to grow,” Chanphirou said.

Source: Insurance Business