The Arewa Youths for Peace and Security has called on the Abuja Metropolitan Management Council (AMMC) to enforce the issuance of special trade licenses for spare parts dealers being relocated from the Apo Mechanic Village.

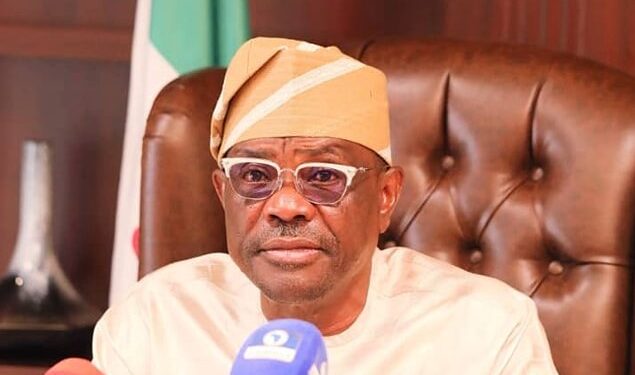

The group’s Secretary-General, Salihu Dantata Mahmud, emphasized the importance of strict regulation in the spare parts sector to ensure safety and boost revenue for the Federal Capital Territory (FCT).

Speaking on Sunday, Mahmud noted that substandard spare parts have significantly contributed to road accidents, and enforcing trade licensing would help address this issue.

“World over, trade licenses are mandatory for spare parts dealers to guarantee quality and safety.

If AMMC makes obtaining the special trade license compulsory, it will not only enhance road safety but also boost the revenue of the FCT administration,” Mahmud said.

The relocation of the traders presents an opportunity to streamline the sector, Mahmud added, highlighting the potential revenue of more than three billion naira annually if the licensing process is properly implemented.

He criticized the non-prioritization of the policy in the past, stating that the lack of regulation has allowed the sale of substandard parts, which endangers lives and properties.

He further urged the FCT administration to capitalize on the opportunity, especially in light of its financial independence from the Treasury Single Account (TSA).

“Only certified dealers should be allowed to operate, as is done globally. This will ensure the sale of original and standard spare parts, reducing accidents caused by faulty components,” he reiterated.

The call comes as the AMMC finalizes plans to relocate Apo Mechanic Village traders to designated areas in the FCT.