The Monetary Policy Committee (MPC) of the Central Bank of Nigeria (CBN), has raised the country’s baseline interest rate by 150 basis points to 26.25 per cent from 24.75 per cent.

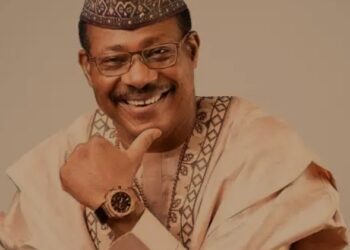

Mr Yemi Cardoso, the Governor of CBN, said this on Tuesday in Abuja, while reading the communique from the 295th meeting of the MPC.

Cardoso, however, said that the committee decided to hold all other parameters constant.

The Cash Reserve Ratio (CRR) was thus, retained at 45 per cent, the Liquidity Ratio of 30 per cent was retained and Asymmetric Corridor of +100/-300 basis points around the MPR was also retained.

Cardoso said that all 12 members of the committee were present at the meeting.

According to him, the key focus of the committee at the meeting remained to achieve price stability by effectively using tools available to the monetary authority to reign in inflation.

He said that members observed that while year-on-year headline inflation in April rose moderately, the month-on-month measures of headline, food, and core inflation all declined significantly.

“This follows a decline month-on-month of headline and food measures in March, suggesting that the recent tight monetary policy stance of the CBN is beginning to yield the desired outcome,” he said.

He said that the MPC, however, noted that inflationary pressure continues to be driven largely by food inflation.

“The committee, thus, reiterated several challenges confronting the effective moderation of food inflation.

“They include rising cost of transportation of farm produce, infrastructure related constraints along the line of distribution network, and security challenges in some food producing areas,” he said.

Cardoso said that “exchange rate pass-through” to domestic prices for imported food items was also an impediment to taming food inflation.

According to him, the MPC urged that more be done to improve the security of farming communities to guarantee improved food production in these areas,” he said.

The News Agency of Nigeria (NAN) reports that this is the third consecutive tightening of the baseline interest rate, known as the Monetary Policy Rate (MPR) by the MPC under Cardoso.

At its 293rd meeting in February, the committee increased the MPR by 400 basis points from 18.75 per cent to 22.85 per cent, and also increased it by 200 basis points, to 24.75 per cent from 22.75 per cent in March.

Meanwhile, an economist, Dr Chijioke Ekechukwu, reacting to the decision of the MPC, urged stakeholders to give the committee the benefit of the doubt.

” Although, a continuous increase of MPR in my opinion, is not going to control inflation. It is rather going to continue to increase it, as the cost of funds will rise.

“This will ultimately be borne by consumers through higher prices of goods and services.

“There are other drivers of inflation, which are not within the control of the monetary policy.

” If a sickness needs a combined doses of two drugs to heal, and you use only one drug, that sickness will remain with the patient,” Ekechukwu said.

Uche Uwaleke, a professor of Capital Market and the president of the Association of Capital Markets Academics of Nigeria, said that the hike in the MPR by a further 150 basis points would most likely have an adverse consequence on the equities market.

According to Uwaleke, this is given the inverse relationship between interest rates and equities market returns.

“It has the potential of triggering portfolio rebalancing in favour of fixed income securities.

“If I were a member of the MPC, I would have voted for a hold position as the aggressive policy rate hike is taking a toll on output.

” Production is stiffled because of very high cost of funds.

“Moreover, the seeming over reliance on the MPR as a tool to tame inflation does not appear to be making any meaningful impact due to the significant non-monetary factors driving inflation in Nigeria,” he said.

He listed such factors to include high cost of energy, transport as well as insecurity in the food-belt regions of the country. (NAN)